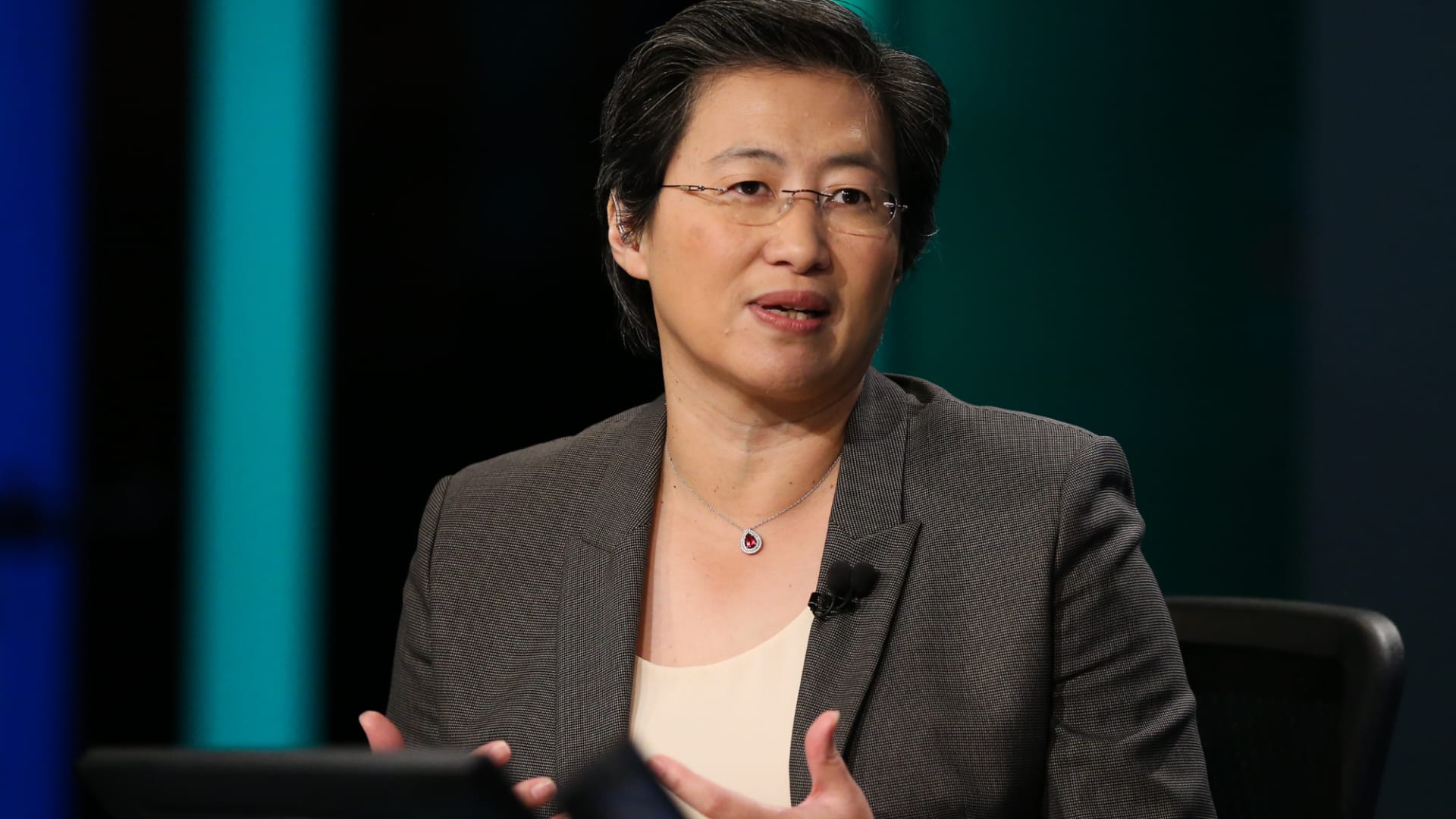

Lisa T. Su, CEO of Advanced Micro Devices

Adam Jeffery | CNBC

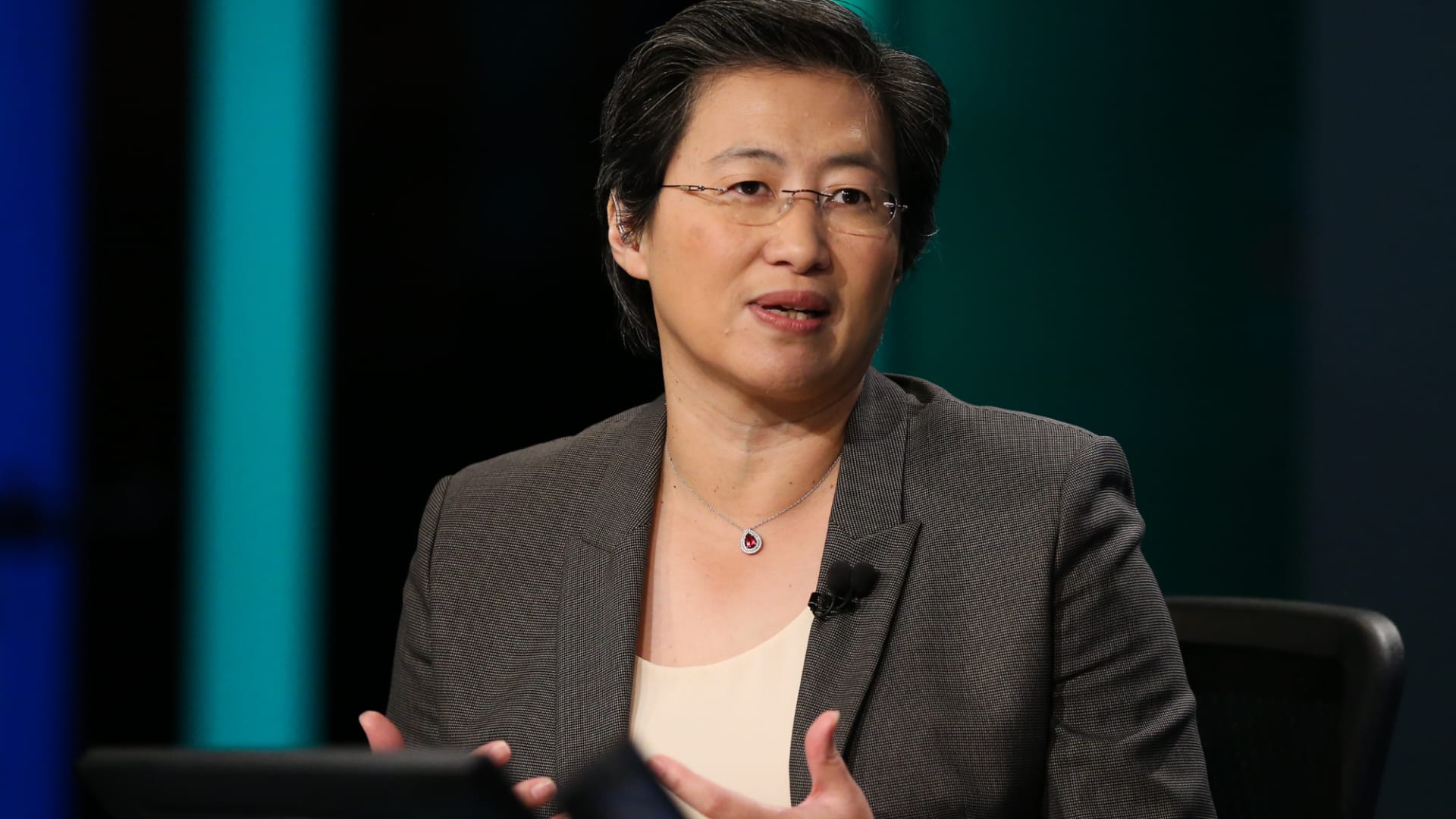

Lisa T. Su, CEO of Advanced Micro Devices

Adam Jeffery | CNBC

Shares fell more than 3% in after-hours trading.

AMD said the shortfall was a combination of a “weaker than expected PC market and significant inventory correction actions across the PC supply chain.”

In its last quarterly earnings results, AMD had already given a forecast for Q3 that was lower than Wall Street expected.

AMD’s Client segment revenue came in at about $1 billion, the company said, down 40% year-over-year. Its Gaming segment generated about $1.6 billion in revenue, up 14% year-over-year, and its Data Center business also generated about $1.6 billion in sales for the quarter, up 45% year-over-year.

The boost in its Embedded business AMD’s Embedded business, which is primarily the result of acquiring Xilinx earlier this year, generated about $1.3 billion.

In total, sales of $5.6 billion were up 29% over Q3 2021 but down 15% from the last quarter.

Overall, the stock is down about 53% for the year while the S&P 500 is down more than 21%.