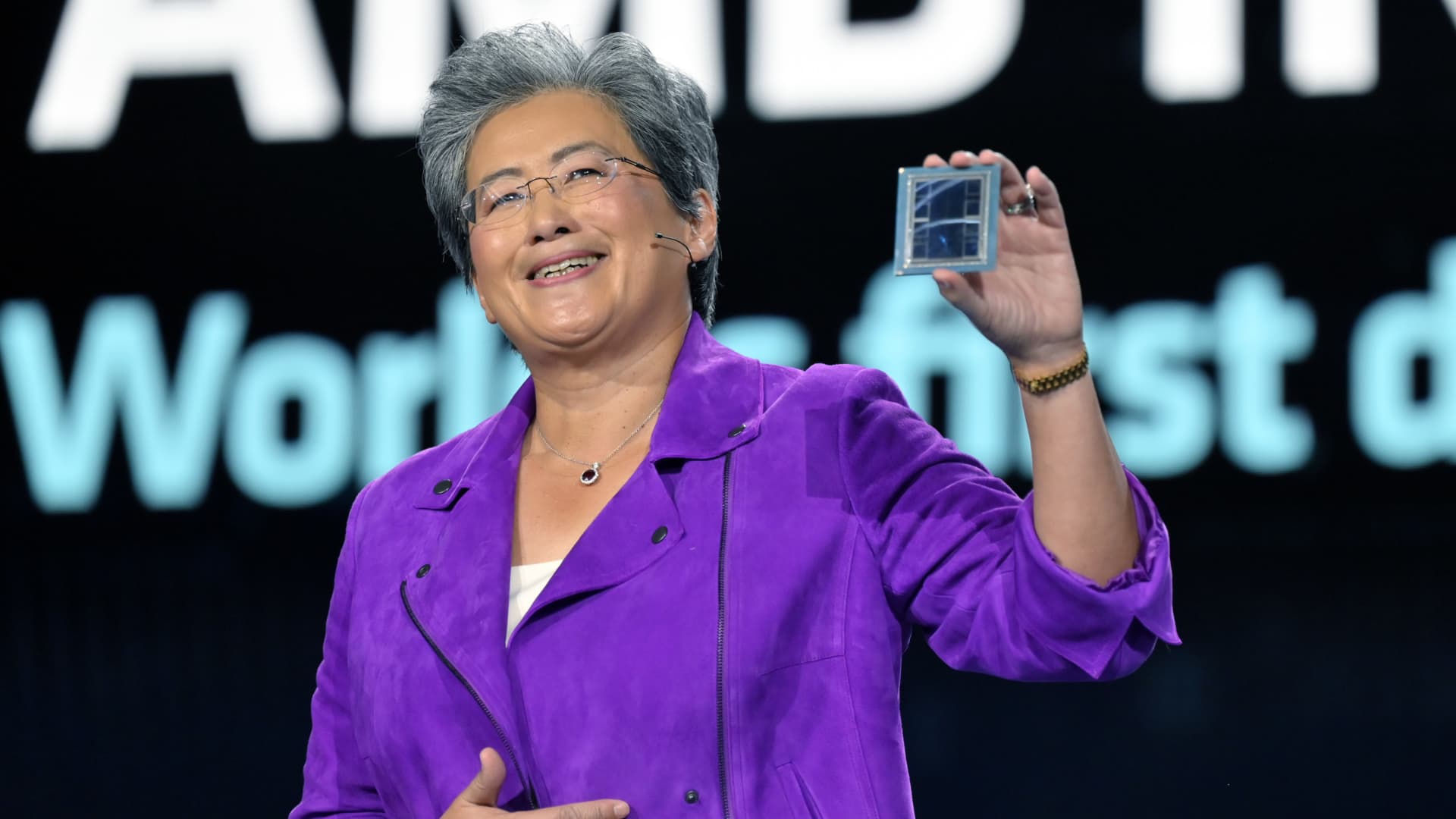

Lisa Su displays an AMD Instinct MI300 chip as she delivers a keynote address at CES 2023 in Las Vegas, Nevada, on Jan. 4, 2023.

David Becker | Getty Images

Demand for graphics processing units — the artificial intelligence chips that power programs such as ChatGPT — has been surging for months, leading to significant gains for the companies that make GPUs.

AMD rose nearly 130% in 2023, as investors bet that the company’s AI-oriented GPUs scheduled to ship this year can take market share from Nvidia and provide an alternative for big buyers like Microsoft and Meta.

But elevated expectations for AI chip growth has led Northland Capital Markets analyst Gus Richard to admit that he’s not sure where AMD shares should go from here.

“We downgrade on valuation to ‘a heck if we know’ rating,” Richard wrote in a note on Monday. He said he has an actual rating of market perform, which is equivalent to a hold.

Richard’s call is based on his view that investor expectations for AI chip growth have spilled into “irrational exuberance.” He predicts total AI chip revenue of $125 billion in 2027 and says the range of expectations is so great that some analysts are estimating $100 billion and others are at $400 billion.

“AI is big, it’s really big, just not as big as investors are thinking,” Richard wrote.

Richard said overall demand signals were distorted for several reasons. First, market leader Nvidia was effectively a “sole source” for AI chips and demand has been outstripping supply. That led to customers “double ordering,” or buying in advance more than they needed. He also cites recent moves from the U.S. to ban certain chip exports to China as something that could weigh on growth.

In Richard’s calculation, If AMD were to sell $16 billion in AI chips in 2027 — doubling every year from $2 billion in 2024 — the company would have about a 13% market share and would continue to spend more on research and development to keep up with Nvidia. He sees $45 billion in total 2027 revenue for AMD and says that figure is already priced into the stock.

AMD shares fell about 3.5% to $168.17 as of Monday afternoon. Nvidia shares were up less than 1%.

WATCH: Jim Breyer says he would add AMD to the ‘Magnificent Seven’