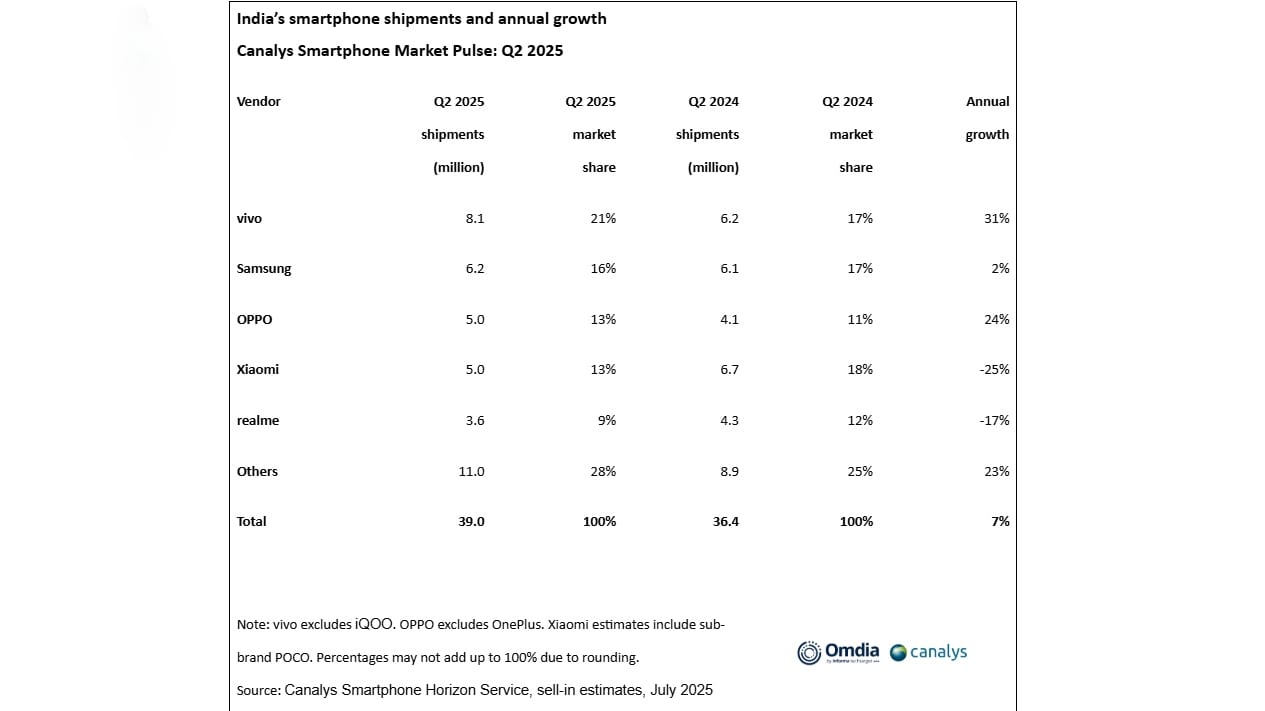

India’s smartphone shipments grew 7 percent year-over-year (YoY) in the April-June period (Q2) in 2025, according to Canalys. The rebound was driven by a wave of new launches, following a cautious first quarter where vendors held back due to elevated inventory levels. Vivo grabbed the top spot in domestic smartphone shipments with 21 percent market share. Samsung came in second place, followed by Oppo. Xiaomi and Realme captured the fourth and fifth positions.

India Smartphone Shipments in Q2 2025

As per the latest Canalys research report, smartphone shipments in India reached 39.0 million units in Q2 this year, recording 7 percent YoY growth from the same period last year. The growth was fueled by new smartphone launches and a restrained Q1 with high inventory.

Vivo topped India’s smartphone market in Q2 this year with shipments of 8.1 million units, capturing a 21 percent market share. Samsung followed with 6.2 million units and 16 percent market share.

Oppo secured third place with shipments of 5 million units, narrowly surpassing Xiaomi, which also shipped 5 million. Both Oppo and Xiaomi received 13 percent market share. Realme ranked fifth by shipping 3.6 million units. The Chinese brand got 9 percent market share in the second quarter.

Photo Credit: Canalys

Canalys notes that Vivo’s V50 series saw strong demand in Tier 1 and Tier 2 cities in Q2. Meanwhile, the Vivo Y-series maintained momentum in smaller cities and semi-urban areas. The T-series also gained ground online, supported by an expanded product lineup.

Oppo’s growth was driven by strong offline momentum from the Oppo A5 series and growing online traction through the Oppo K13 series, said the report. Canalys says Samsung capitalised on its financing power in the mid-premium segment by offering EMI options, especially for the Galaxy A36 and Galaxy A56.

According to Canalys, Xiaomi, despite a year-on-year decline, regained some momentum in Q2 with the Redmi 14C 5G and Redmi A5. The launch of the Redmi Note 14 series also boosted growth. Realme also saw a year-on-year dip, but its offline traction was driven by models like the Realme C73, Realme C75, and Realme 14X.

Apple secured a sixth spot, with the iPhone 16 lineup making up over 55 percent of its shipments. However, the report states that iPhone 16e saw declining interest. Motorola ranked seventh, while Nothing saw a remarkable 229 percent YoY growth. Infinix surpassed Tecno to become Transsion’s top brand in India, contributing 45 percent of the group’s 1.8 million shipments.

“With limited organic demand, India’s smartphone market in H2 2025 will hinge more on channel execution than product launches,” said Sanyam Chaurasia, Principal Analyst at Canalys. The market research firm projects a modest decline for the full-year 2025, “as structural demand challenges persist”.