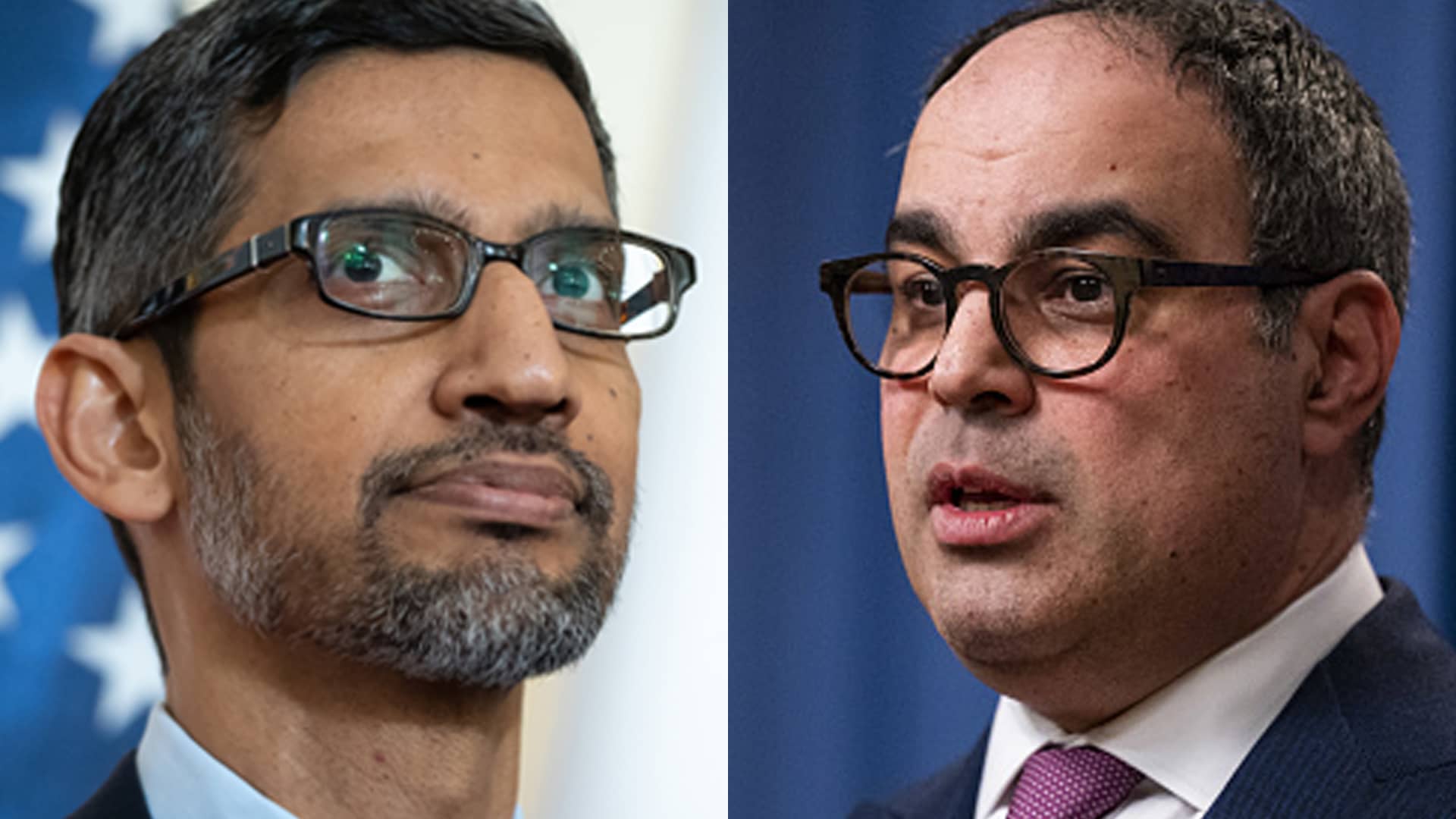

Google CEO, Sundar Pichai (: and Jonathan Kanter, assistant attorney general of antitrust for the US Department of Justice (R).

Getty Images

The biggest tech monopoly trial since the Department of Justice challenged Microsoft more than 20 years ago is set to begin Tuesday, kicking off a new chapter of anti-monopoly enforcement in the U.S.

Over the next few months, the DOJ and a collection of state attorneys general will make their case to a D.C. District Court judge for why Google has allegedly violated anti-monopoly law through exclusive agreements with mobile phone manufacturers and browser makers to make its search engine the default for consumers. Google, in turn, will seek to tell the judge why its behavior is not anti-competitive and instead provides a better experience for consumers.

While the trial marks the tech sector’s first major anti-monopoly proceeding in decades, Google is squarely in the middle of its antitrust battles. It’s already faced major fines over its competitive practices in Europe, and months after it wraps arguments in the search trial, it’s set to face a second challenge from the DOJ in the Eastern District of Virginia over its advertising technology business.

At stake in this trial is the chance for the DOJ to prove it can bring a successful anti-monopoly case in the modern digital age. The DOJ will likely strive to show that enforcement of the antitrust laws, not the absence of them, is what can unlock innovation, just as many believe its victory in the Microsoft case paved the way for a generation of companies including Google to thrive in a more open internet ecosystem.

For Google, it’s fighting to preserve a long-standing business practice that it sees as an important way to make its search products accessible to consumers, which it says creates the best experience for them.

Here’s what to expect as the trial begins on Tuesday.

What the trial is about

A key focus of the trial will be on two kinds of agreements Google has made with other companies. One type of agreement relates to the payments Google makes to browser makers like Apple to be the default search engine on the iPhone’s Safari browser and other devices. The other type is Google’s contracts with phone manufacturers that run Google’s Android operating system, which require them to preload certain Google apps.

The government argues that these arrangements locked up important distribution channels for search, creating overwhelming barriers to entry for rival search engines to compete with. Because of Google’s alleged dominant position in the market, the government contends that these moves violated antitrust law by illegally maintaining a monopoly.

The states will also argue an additional claim: that Google failed to make its popular search advertising tool, Search Ads 360 (SA360), sufficiently interoperable with Microsoft’s Bing. Instead, they allege in the complaint, Google “favors advertising on its own platform and steers advertiser spending towards itself by artificially denying advertisers the opportunity to evaluate the options that would serve those advertisers best.”

Colorado Attorney General Phil Weiser, who has led the coalition of states, told CNBC in an interview that their case and the DOJ’s “are really hand-in-glove.”

“The cases have very compatible theories, and the core message from both is that Google’s monopoly power has been abused, harming competition and hurting consumers,” Weiser said.

Colorado attorney general Phil Weiser speaks during a press conference announcing an indictment of the three Aurora police officers and two Aurora fire paramedics in the death of Elijah McClain on Wednesday, September 1, 2021.

Aaron Ontiveroz | MediaNews Group | The Denver Post via Getty Images

One argument that won’t make it to trial are the states’ allegations that Google suppressed vertical search providers, or search services that are focused on a specific topic, such as Yelp and Tripadvisor. The judge did not allow that claim to move forward. Still, antitrust experts interviewed for this article said that in some ways, the omission could actually help the government deliver a more straightforward and streamlined argument by dedicating more time to other theories.

The government is likely to argue that Google’s behavior has stifled innovation that would otherwise benefit consumers. That could be because the high barriers to entry in the market could discourage rivals and because the lack of competition could lessen Google’s own incentive to innovate.

But Google has maintained that its actions have legitimate business purposes and are made to enhance consumer experience with its products.

Points of conflict

One likely area of disagreement will be how the government defines the market that Google has allegedly monopolized. While Google did not contest the definition of the general search market in its motion to dismiss the case, it could still do so in its trial arguments.

While the government defines the general search market as including direct Google rivals like Bing and DuckDuckGo, Google has alluded to other tools that consumers commonly use to search online. For example, in a blog post previewing its defense, Google’s president of global affairs, Kent Walker, pointed to an Insider Intelligence report that found 60% of U.S. product searches start on Amazon. Walker wrote that the abundance of places where consumers can use online search shows that Google hasn’t foreclosed competition.

Still, much of the trial is likely to focus on whether Google’s alleged exclusionary contracts can be considered bad acts used to further its monopoly. That means the behavior doesn’t have a legitimate business purpose “besides aggrandizing or keeping your market power,” according to Rebecca Haw Allensworth, an antitrust professor at Vanderbilt Law School.

“I think the judge is probably inclined to find that Google has substantial monopoly power,” said Bill Kovacic, who teaches antitrust at George Washington University Law School and is a former FTC chairman. “So the attention is going to be focused on the behavior. And one of Google’s principal themes will be that everything we do gives the user a better experience. And that the net effect of each practice is to make the user better off than they would be otherwise.”

One important part of the case will be examining the payments Google makes to Apple to secure its place as the iPhone’s default search engine in its Safari browser. On the one hand, the government may argue that the billions of dollars Google is estimated to spend on that position shows just how valuable it sees that placement and the level of sacrifice Google is willing to take on to be the default, according to Allensworth.

Google CEO Sundar Pichai (L) and Apple CEO Tim Cook (R) listen as U.S. President Joe Biden speaks during a roundtable with American and Indian business leaders in the East Room of the White House on June 23, 2023 in Washington, DC.

Anna Moneymaker | Getty Images

On the other hand, Allensworth added, Google might argue that prominent placement in Apple’s browser means more eyeballs for its own advertisers, and ultimately more revenue, which could be a legitimate business justification.

Allensworth said she expects the government to bring in experts that attempt to argue that the payments for default placement “economically don’t make sense,” beyond an effort to cut out rivals.

One additional element that will be discussed is Google’s alleged destruction of evidence once it reasonably expected litigation. The government alleged that Google failed to preserve chat messages between employees that should have been under legal hold and prevented from auto-deleting.

“That type of destruction and failure to preserve evidence is really troubling,” Weiser said. “And the judge has said that’s something he’s willing to consider in this case. And we just want to underscore that as the judge looks at this case, we didn’t have full access to the evidence because of the conduct of Google.”

Google has said that company officials “strongly refute the DOJ’s claims.”

“Our teams have conscientiously worked for years to respond to inquiries and litigation,” a spokesperson said in a statement earlier this year. “In fact, we have produced over 4 million documents in this case alone, and millions more to regulators around the world.”

What to expect on Tuesday

The first day of the trial will set up the arguments for what could take as long as 10 weeks. Each party will give its opening statements before the DOJ begins presenting its case-in-chief. That means the government will call on both expert and industry witnesses to help make its case.

After the DOJ concludes its main presentation, the states will have their turn, followed by Google. Afterward, the plaintiffs will likely get a chance to rebut Google’s arguments.

Antitrust trials are a long process, and even if Google is found liable at this stage, there could be another separate proceeding to determine the best solution for resolving the concerns.

In the next few weeks, one of the most interesting things to watch for will be who is called to testify. In addition to experts like economists, expect to see Google executives called to the stand, potentially including CEO Sundar Pichai. The court will likely also hear testimony from third parties referenced in the case, like Mozilla and Apple or rivals like Microsoft or DuckDuckGo.

What’s at stake

The case’s outcome will be a significant statement on the status of antitrust law in the U.S. and how it should be applied to dominant tech firms. While the court will consider specific remedies only if Google is found liable for the allegations at this stage, a favorable ruling for the government could ultimately result in restrictions on Google’s business practices or even the break up of parts of its business.

Google would view such a ruling as ultimately harmful for consumers.

“A ruling that says your products are too good or too successful, you can no longer pay to promote them,” would be out of step with American law and “not good for the ecosystem and not good for consumers,” according to Google’s Walker.

But supporters of the government’s case believe consumers will be subject to a deteriorating search experience if the court rejects its arguments.

“If Google is allowed to maintain its monopoly through illegal default search agreements while hampering competition, what that means is Google maintains its monopoly with a worse product,” said Lee Hepner, legal counsel at the American Economic Liberties Project, which advocates for more enforcement of antitrust laws in markets including tech.

The outcome will also be an important signal of the ability of the government to bring successful tech antitrust cases in the future, and whether current law can sufficiently account for the nuances of digital markets.

For the government, winning this trial would be a significant victory, strengthening the DOJ’s currently mixed record in court under antitrust chief Jonathan Kanter and signaling it can tell a compelling story about technical digital markets. A loss would be a blow to those efforts, but would likely be used as fodder in Congress to push for new antitrust laws.

For the government, winning the trial may also be seen as a chance to open the digital ecosystem for the next generation of tech businesses. Many credit the Microsoft case with that effect, and this trial comes as artificial intelligence ushers in a new wave of technology and likely many new companies.

But Matt Schruers, president of the Computer & Communications Industry Association, of which Google is a member, sees the rise of AI as complicating the government’s arguments. Google is one of the leaders in generative AI with its chatbot Bard, though OpenAI released ChatGPT first.

“That argument could not come at a more awkward time for the government, given the amazing innovations that we’ve seen come to market by companies that are not Google,” Schruers said. “We’re in the midst of an overwhelming sea change in technology, and the government has to say, ‘These contracts are holding technological innovation back.'”

WATCH: Google faces fast and furious pace of lawsuits as antitrust scrutiny intensifies