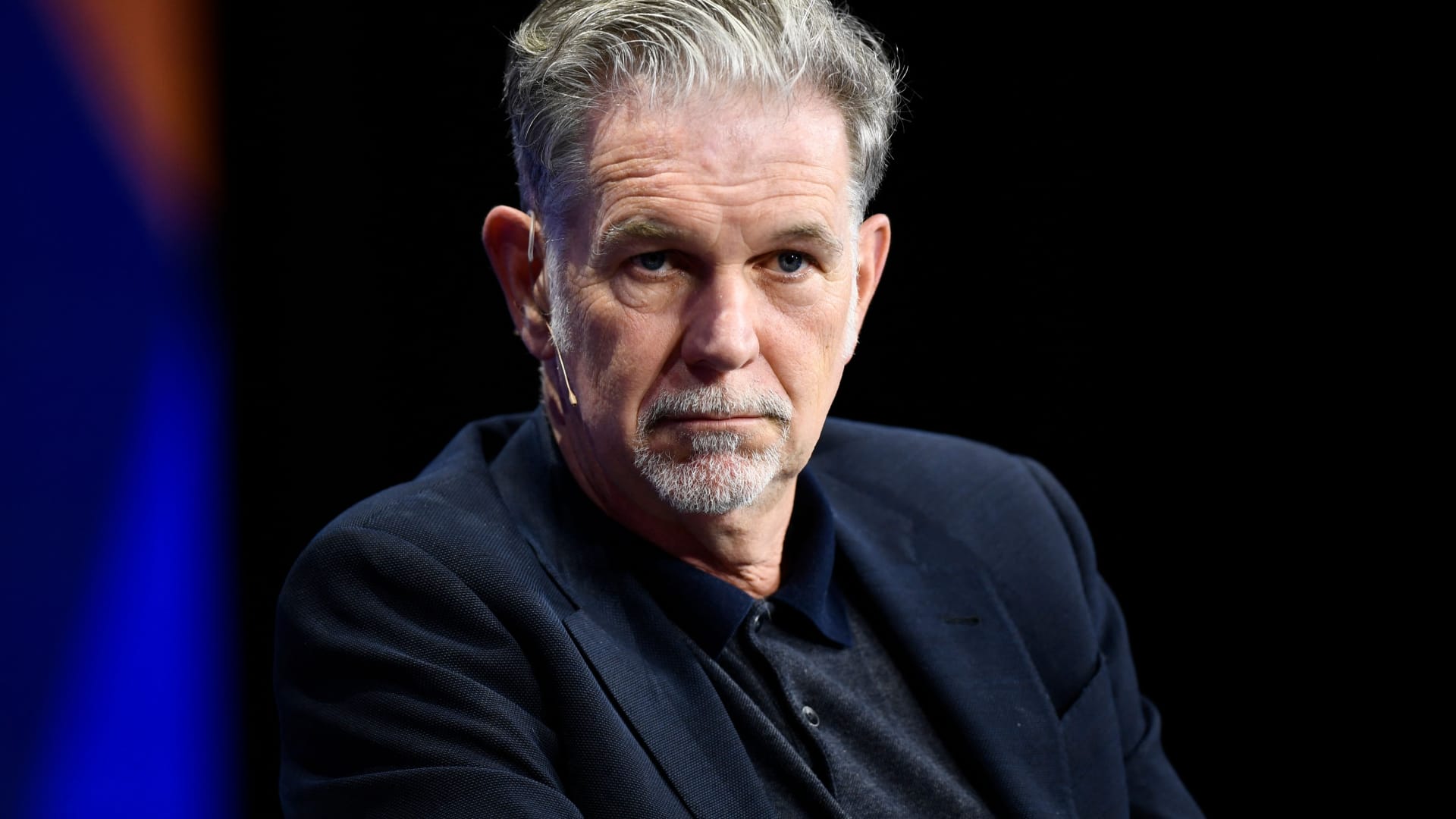

Reed Hastings, co-CEO of Netflix, participates in the Milken Institute Global Conference on October 18, 2021 in Beverly Hills, California.

Patrick T. Fallon | AFP | Getty Images

Netflix on Tuesday posted mixed financial results and said it was pushing back its broad rollout of its password-sharing crackdown.

Originally, Netflix wanted the rollout to take place late in the first quarter, but on Tuesday it said it would do it in the second quarter.

related investing news

“While this means that some of the expected membership growth and revenue benefit will fall in Q3 rather than Q2, we believe this will result in a better outcome from both our members and our business,” the company said in its earnings release.

The company said it saw its subscriber growth impacted in the international markets where it has already rolled out such initiatives.

Here are the results Netflix reported Tuesday versus estimates from analysts polled by Refinitiv:

- Earnings per share: $2.88 vs $2.86 expected

- Revenue: $8.16 billion vs $8.18 billion expected

For the quarter ended March 31, Netflix reported earnings of $1.31 billion, or $2.88 a share, compared with $1.6 billion, or $3.53 a share, a year earlier. Revenue grew to $8.16 billion from $7.87 billion in the prior-year period.

Shares of Netflix initially fell more than 10% but recovered to rise slightly in after hours trading.

Netflix’s crackdown on password sharing has been top of mind for investors. Late last year, the company said it would begin rolling out measures to have people who have been borrowing other accounts create their own.

The company has said more than 100 million households share accounts, or about 43% of its global user base. That has affected its ability to invest in new content, Netflix has said. Both the ad-supported option and crackdown on password sharing are meant to boost profits.

In February, Netflix outlined password-sharing guidance in four countries: New Zealand, Canada, Portugal and Spain. The company said it would ask users in those countries to set a “primary location” for their accounts, and allow users to establish up to two “sub accounts” for those who don’t live in their home base for extra fees.

Netflix said Tuesday it has been pleased with its push to mitigate password sharing. In Latin America, the company said it saw cancellations after the news was announced, which affected near-term growth. But, Netflix added, those password borrowers would later activate their own accounts ad add existing members as “extra member” accounts. As a result, the company said, it is seeing more revenue.

Canada, which will likely serve as a template for the U.S., has seen its membership base grow due to the launch of paid sharing, and revenue growth has accelerated and “is growing faster than in the U.S.”

The company said that as it rolls out its paid sharing initiatives, it expects near term engagement – which is measured by Nielsen for its ad-supported tier – to “likely shrink modestly.” Still, the company believes it will bounce back as its seen in international regions.

Expecting a revenue bump

Netflix said it believes paid sharing will ensure increased revenue in the future as it looks to improve its service. On Tuesday, Netflix said it expects to spend in the range of roughly $17 billion in 2024 on content, a sign the streamer isn’t pulling back like some of its peers.

Netflix noted on Tuesday that “competition remains intense as we compete with so many forms of entertainment.”

On Tuesday, Netflix said goodbye to what got it started — its DVD mailing business, in which it would send out the discs in red envelopes to customers. The company’s CEO Ted Sarandos said in a blog post that it would finally wind down the DVD business, which “continues to shrink.”

A year ago, Netflix had reported its first subscriber loss in a decade, sending its shares on a downward spiral, as well as those of its media peers. The results pushed Netflix and its streaming rivals to focus on profits over subscriber numbers.

As Netflix looked to boost its profits and subscriber base, it turned its focus to an ad-supported plan, as well as the password sharing crackdown.

Last November, Netflix unveiled its cheaper tier with commercials, which costs $6.99 a month. The ad-supported tier came shortly after it lost subscribers as streaming competition ramped up.

Sarandos recently said the company is likely to offer multiple ad-supported tiers in the future.

Netflix’s ad-supported plan now has an average of 95% of the same content as what is on its commercial-free plans due to recent licensing deals, the company said Tuesday.

“We are pleased with the current performance and trajectory of our per-member advertising economics,” Netflix said Tuesday.