Samsung said it will make a 300 trillion Korean won investment in a new semiconductor facility in South Korea over the next two decades. It is part of a broader tech investment plan by the South Korean government.

SeongJoon Cho | Bloomberg | Getty Images

Samsung Electronics said Wednesday it plans to invest 300 trillion Korean won ($228 billion) in a new semiconductor complex in South Korea, which the government says will be the world’s largest, as part of an aggressive push by the country to take a lead in critical technologies.

The investment will happen over the years to 2042, a Samsung spokesperson told CNBC.

The South Korean government is looking to join together its biggest technology companies to spur development in key areas. The government said Wednesday that 550 trillion won will be invested by the private sector by 2026 in areas including chips, displays, batteries and electric vehicles.

But the big focus is on semiconductors — critical components that go into everything from smartphones to cars — and that have increasingly become a geopolitical focal point. South Korea’s expansive move is seen as a way to catch up with the U.S.’s own aggressive chip investments.

“President Yoon Suk-yeol said, while it’s important for a high-tech industry such as semiconductors to grow through a mid-to-longer term plan, we must swiftly push ahead with these plans as if it’s a matter of life and death, given the current situation of global competition,” Yoon’s spokesperson Lee Do-woon said in a briefing.

The new 300 trillion won chip complex Samsung is building will be just outside of the South Korean capital of Seoul.

South Korea’s government aims to connect chip facilities in the area from Samsung to other companies to create a “semiconductor mega cluster.” The idea is to link up various parts of the semiconductor supply chain from chip design to manufacturing.

“In selecting the new locations, we’ve taken into consideration the synergy effect that could be seen from existing semiconductor clusters,” Lee Chang-yang, South Korea’s trade, industry and energy minister, said.

The South Korean government said that companies will build five chip manufacturing facilities in the cluster.

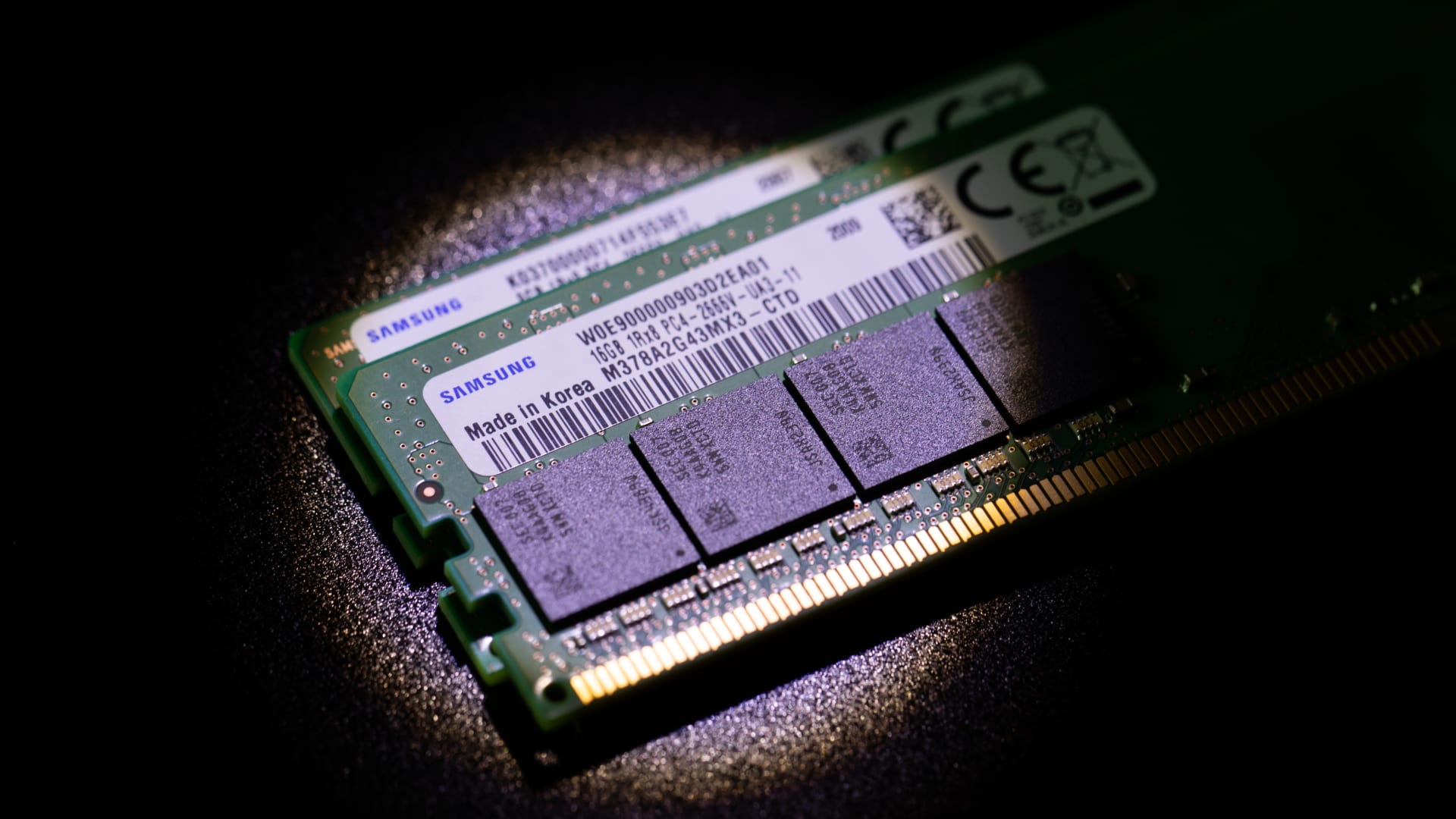

Samsung is the world’s biggest memory chip maker. These are semiconductors that go into devices such as laptops and servers. South Korea is also home to SK Hynix, the second-biggest memory chip maker.

Semiconductor rivalries heat up

Semiconductors have become a highly politicized technology and have created a complex dynamic between allied countries, driven by the U.S.’s twofold strategy.

On the one hand, Washington has pushed to bring chip manufacturing back to U.S. shores and has got commitments from companies including Samsung and Taiwan’s TSMC, the biggest contract chipmaker, to build factories.

On the other hand, the U.S. has sought to hold back China’s semiconductor development. Last year, Washington introduced sweeping rules aimed at cutting China off from obtaining or manufacturing key chips and components and the tools required to make them.

In its tech battle with China, the U.S. has looked to strike alliances with South Korea, Japan, Taiwan and the Netherlands to help cut China off from key technology.

But at the same time, the U.S. signed the Chips and Science Act which includes $52 billion in support for companies producing chips in a bid to attract investment into America and boost the country’s standing in the semiconductor industry.

That has created a competitive landscape between allied nations even as they seek partnerships.

“As of now, every country is trying to build its own competitive strengths. There is a flood of tax breaks and capital commitments from governments seeking to onshore semiconductor production,” Pranay Kotasthane, chairperson of the high tech geopolitics program at the Takshashila Institution, told CNBC.

“The impulse for competition is stronger than the impulse for cooperation. Incentives might change if the planned incentives don’t work or when the semiconductor industry sees a downward trend in the investment cycle.“

Samsung manufacturing push

For Samsung, the government’s support could help it catch up with TSMC — the biggest contract chipmaker. TSMC manufactures some of the most advanced semiconductors in the world for companies such as Apple.

Samsung, known for consumer electronics and memory chips, is looking to ramp up its contract chipmaking, or foundry business.

In October, the company laid out an ambitious roadmap to manufacture the most advanced chips in the world by 2027.

Samsung shares closed 1.3% higher in South Korea on Wednesday after the announcement of its chip investment plans.