Snowflake Chairman Frank Slootman attends the Snowflake Summit 2022 in Las Vegas on June 14, 2022.

Snowflake | Via Reuters

News of Snowflake CEO Frank Slootman’s retirement sparked an 18% plunge in the company’s stock price on Thursday, its steepest selloff since the data analytics software vendor debuted on the New York Stock Exchange in 2020.

Slootman’s departure was announced late Wednesday as part of Snowflake’s quarterly earnings report, which included disappointing guidance. Analysts at Mizuho Securities wrote in a note that the stock is getting hammered “as investors digest the resignation” of Slootman, who joined in 2019 and led the company through its blockbuster IPO the following year.

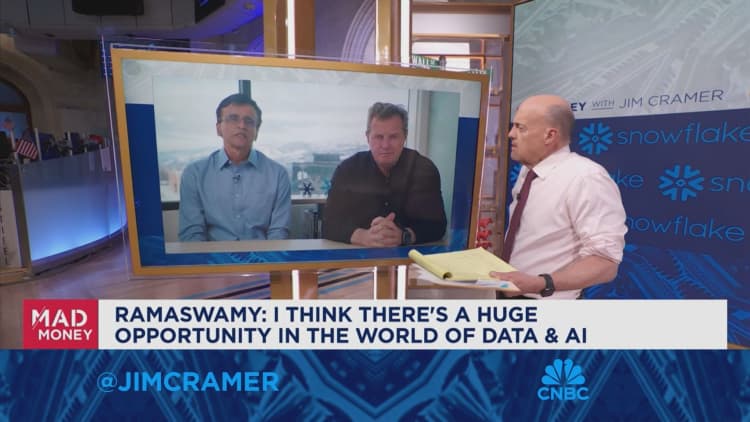

While the announcement caused consternation on Wall Street, Slootman told CNBC that he’s not worried about a wave of Snowflake employees following him out the door.

“This is not a personal cult, OK?” Slootman said.

Slootman, 65, is being succeeded by former Google ad chief Sridhar Ramaswamy, who joined Snowflake in June via the company’s $185 million purchase of Neeva, a startup Ramaswamy co-founded in 2019.

Snowflake was the third enterprise technology company that Slootman shepherded through the IPO process, following Data Domain in 2007 and ServiceNow in 2012. Snowflake marked his biggest financial windfall. He controlled roughly 6% of the company’s stock at the time of the IPO, and owned 10.6 million shares as of Feb. 9, a stake that’s currently worth about $2 billion.

Additionally, Slootman’s total compensation in 2023 amounted to $23.7 million, almost entirely from stock and option awards.

Before joining Snowflake, Slootman spent about six years as CEO of ServiceNow. He told CNBC that ServiceNow has continued to flourish since his departure. Annualized revenue has grown from $1.5 billion to almost $10 billion.

“Some people are still there that I hired — quite a few of them, actually,” Slootman said. “There’s also new ones, obviously.”

ServiceNow’s workforce stood at 23,668 by the end of 2023, compared with 603 in December 2011, months after Slootman had joined, according to regulatory filings.

“We put ServiceNow on the rails. We’ve done that with Snowflake as well,” said Slootman, who’s sticking around as chairman.

Taking three companies through big and successful exits is a rare feat in technology, and has gained Slootman plenty of acclaim. But he’s also attracted attention for stepping into controversy on issues like the tech industry’s focus on diversity. In 2021, as corporate America was wading through the fallout of the George Floyd murder, Slootman noted that diversity shouldn’t trump merit. He later apologized.

In his 2022 book “Amp It Up,” Slootman offered advice leaders on how to raise standards inside companies, citing Steve Jobs’ insistence on greatness at Apple. “Don’t let malaise set in,” he wrote.

Founded in 2012, Snowflake built a cloud-based data warehouse for storing and analyzing corporate information. Now the company wants to help clients build artificial intelligence models and applications on top of the data.

Ramaswamy said Snowflake has a clear vision, with the data cloud at the center and apps around it.

“Just delivering on that at scale with speed is what I’m going to do,” he said.

The challenge will be to maintain the company’s momentum.

Snowflake generates about $3 billion in annualized revenue, growing at about 32% a year, compared with under $200 million before Slootman replaced former Microsoft executive Bob Muglia as CEO in 2019. As it tries to continue its rapid expansion, Snowflake faces competition from Databricks, valued at $43 billion last year in an investment round that included Capital One, which previously backed Snowflake.

After Snowflake bought Neeva, Slootman said he made an effort to get to know Ramaswamy. The company put Ramaswamy in the most critical role at the time, leading its AI efforts. Slootman had a realization.

“Holy s—, this is the opportunity we’ve been waiting for,” he said.

Ramaswamy said he’s been spending a lot of time with Slootman. They’ve traveled together to London and Berlin, along with domestic trips to Arizona and Las Vegas. Ramaswamy said he’s held conversations with over 100 clients, including many with Slootman.

Now that he’s at the helm, Ramaswamy has to deal with the naysayers.

“It is no doubt concerning to see Mr. Slootman, who has a strong track record and is well regarded by investors, step down after five years in the role,” Deutsche Bank analysts wrote in a note on Thursday, though they maintained their buy recommendation on the stock.

But nobody has more at stake in Ramaswamy’s success than Slootman, who remains one of the company’s biggest investors.

“Snowflake is in an extremely good place, having Sridhar at the helm,” he said.

WATCH: Part of Snowflake’s downfall is related to CEO Slootman’s retirement