Taiwan plays a critical role in the AI chip revolution and the global semiconductor industry, the chief executive of the Taiwan Stock Exchange told CNBC in an exclusive interview.

Sherman Lin, chairman and CEO of Taiwan Stock Exchange Corporation attributed the strong gains on the Taiwan Weighted Index to “the AI revolution.”

“It is just because [of] the high demand of the high-end chip, and also the server supply chain. That’s why our stock market is going up,” he said.

The Taiex has risen 27.93% in the last 12 months, but gave up some gains on Friday after most major markets in the region sank amid rising Middle East tensions.

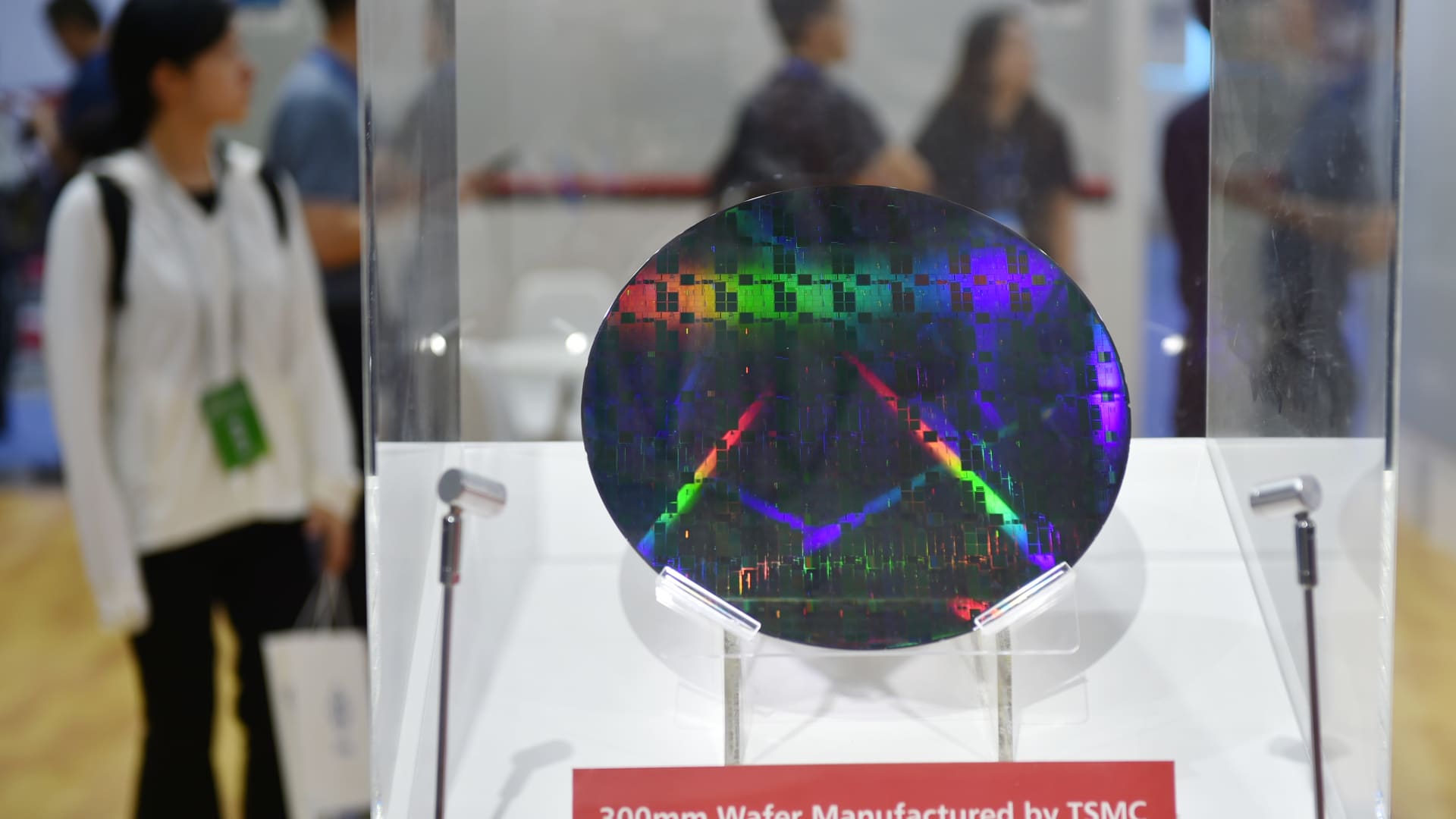

Much of Taiwan’s dominance in the global semiconductor industry can be attributed to Taiwan Semiconductor Manufacturing Co, the world’s largest contract chipmaker that produces advanced processors for clients like Apple and Nvidia. TSMC is the main manufacturer of Nvidia’s powerful AI processors.

“I think this is a lot of attraction for investors … So it means, actually, Taiwan plays [a] very crucial role in AI supply chain and also the semiconductor industry,” said Lin.

Taiwan’s chip dominance

In 2023, Taiwan led advanced chip manufacturing technology, including 16- or 14-nanometer and more advanced processes, with 68% global capacity share, according to TrendForce data. This was followed by the U.S. (12%), South Korea (11%), and China (8%), the data showed.

Taiwan also held nearly 80% market share in extreme ultraviolet generation processes, such as 7-nanometer and more advanced technology, said TrendForce. The smaller the nanometer size, the more powerful the chip is. EUV tools are critical in the production of the world’s most advanced processors.

“We have very good fundamentals of ICT industries. So we can have the strength to facilitate, leveraging the success of the ICT and technology industries, new economy business,” said Lin.

Quake and geopolitical risks

Earlier this month, Taiwan was hit by its strongest earthquake in 25 years. TSMC said construction sites were normal upon initial inspection, though workers from some fabs were briefly evacuated. Those workers subsequently returned to their workplaces.

“Taiwan shows very good resilience … I understand that some listed companies that report to the TWSE – they had very little impact on their productions,” said Lin.

“The kind of the challenge for Taiwan is the testing for our business continuity plan. We actually did quite well. And we refreshed, we responded really quickly. So you can see in the capital market, you can see the adjusted rebound quite soon,” said Lin.

“Right now, it’s still in the uptrend in the capital market after the earthquake.”

On the outcome of the U.S. elections and military conflicts, Lin said such situations “will always affect some capital markets” as well as the Taiwan market.

“But [as] you can see, it will go back to the fundamentals. So I think Taiwan has good fundamentals, [has] resilience and [responds] quickly. I am pretty confident about our capital markets,” said Lin.