Former Treasury Secretary Steven Mnuchin is building an investor group to acquire ByteDance’s TikTok, as a bipartisan piece of legislation winding its way through Congress threatens its continued existence in the U.S.

The House of Representatives on Wednesday passed a bipartisan bill that if signed into law would force ByteDance to either divest its flagship global app or face an effective ban on TikTok within the U.S.

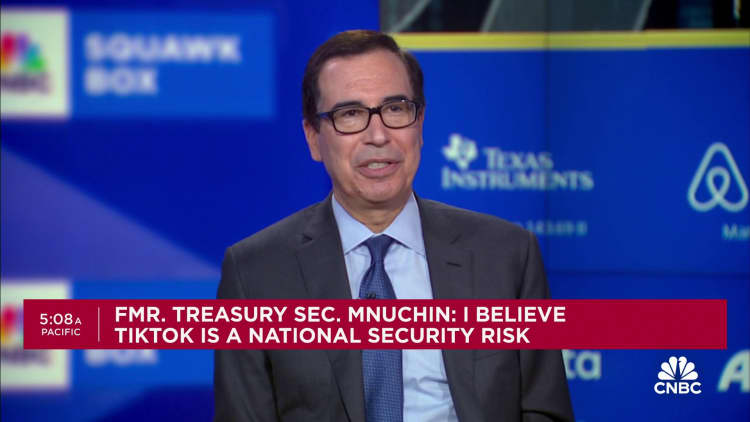

“I think the legislation should pass and I think it should be sold,” Mnuchin, who leads Liberty Strategic Capital, told CNBC’s “Squawk Box” on Thursday. “It’s a great business and I’m going to put together a group to buy TikTok.”

There is common ground between Liberty and ByteDance. Masa Son’s SoftBank Vision Fund invested in ByteDance in 2018, and is also a limited partner in Mnuchin’s Liberty Strategic.

The bill is now headed to the Senate, where its future is uncertain, though President Joe Biden has said that he will sign the legislation if reaches his desk.

“This should be owned by U.S. businesses. There’s no way that the Chinese would ever let a U.S. company own something like this in China,” Mnuchin said.

Lawmakers on both sides of the aisle have highlighted TikTok’s reach in the U.S. — by its own estimates, 170 million Americans use the app — as providing the Chinese government with ready access and influence over the U.S.

Major tech investors, including Peter Thiel, Vinod Khosla and Keith Rabois, have publicly or privately decried the social media platform as a pernicious influence.

Still, it remains unclear if the Chinese government would permit ByteDance to sell TikTok to a U.S. buyer. TikTok has lobbied furiously against the bill, including a concerted pitch to its user base and through videos on its platform.

TikTok CEO Shou Zi Chew has implied that a sale is not an option. China Foreign Ministry spokesperson Wang Wenbin described the bipartisan push as indicative of “robber’s logic” toward TikTok, the Financial Times reported Thursday.

ByteDance was valued at $220 billion at its last funding round in 2023, according to PitchBook data. While a discrete valuation for TikTok was not immediately clear, any sale price for the U.S. division would likely be less.

TikTok’s most valuable asset and, to lawmakers, its most worrying weapon, is its algorithm, which delivers tailored content to users and was developed in China. Any sale of TikTok without the algorithm would be significantly less attractive to potential buyers.

Mnuchin did not specify who the other investors would be in such a deal or the potential valuation for the social media site.

There are other interested buyers. The Wall Street Journal reported Sunday that former Activision Blizzard CEO Bobby Kotick was shopping a potential deal to prospective partners.

Last week, Mnuchin’s Liberty Strategic Capital was a lead investor in a $1 billion capital raise to stabilize New York Community Bancorp.

Mnuchin served as Treasury secretary under former President Donald Trump. That administration also took an antagonistic stance toward TikTok, which ultimately resulted in ByteDance striking a data partnership with Oracle. Trump has since reversed course and come out against a TikTok ban.

TikTok did not immediately respond to a request for comment.