People using their mobile phones on July 17, 2016 in Surakarta, Indonesia.

Solo Imaji | Barcroft Media | Getty Images

Smartphone shipments in Southeast Asia continued a resurgence at the start of 2024, contrasting to a lull in other regions, as the promising market for mobile makers continues to attract more brands and investment.

The top five markets in the region saw 7.26 million smartphone units shipped, marking a significant 20% increase from the same period last year, according to research from technology market analyst firm Canalys published Wednesday.

The results continue a market rebound that began in the fourth quarter of 2023 when Southeast Asia phone shipments increased year-over-year for the first quarter in almost two years amid a broader post-pandemic industry recovery.

According to Canalys analyst Le Xuan Chiew, stabilizing inflationary pressures buoyed by government support and momentum from year-end 2023 sales events in the region have seen consumer sentiment and expenditure rebound.

“To capitalize on this market resurgence, smartphone manufacturers, which adopted conservative strategies in the last six months, are now deploying aggressive tactics to gain market dominance,” he said in the release, noting trends such as affordable 5G, AI integration, ecosystem development, and channel optimization.

In January, Samsung regained its top market share spot in the region thanks to the successful launch of its premium S24 series, which offered increased battery life and new AI capabilities.

But, Chinese competitors are focusing more on the market, gaining ground and offering new phone models at competitive prices. Xiaomi, the second largest phone brand by shipments in January for that region, saw year-on-year growth of 128%, while Transsion, a relative newcomer to the market, saw growth of 190%.

“The region’s increasing disposable income from an expanding middle-class and young population entering the workforce are strong reasons to expect increased investments,” said Cheiw.

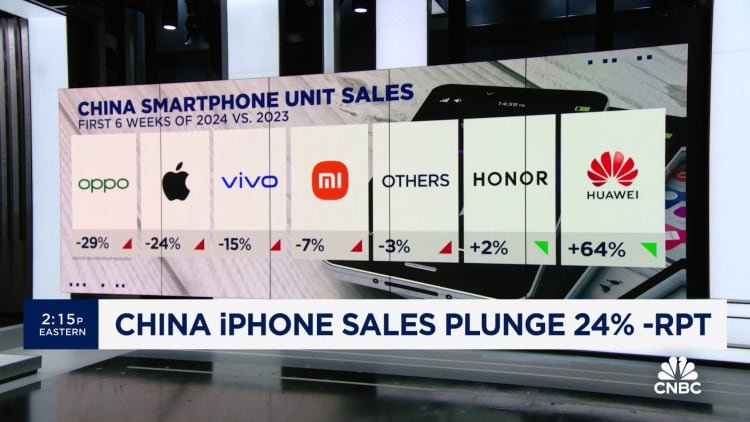

The strong smartphone shipments in Southeast Asia contrasted with China, the largest smartphone market globally, which saw smartphone sales fall 7% in the first six weeks of 2024 year-over-year, according to a Tuesday report from Counterpoint Research.

While the decline in sales in China was magnified by unusually high sales at the start of 2023, other factors have kept the market down, senior analyst Ivan Lam said in the report.

“Consumer confidence will need to rise to stabilize the market, but it is a tough call right now with everything that is happening, especially in the real estate sector,” he said.

One casualty has been Apple, whose smartphone shipments in China declined 24% in the first six weeks of the year, according to the research. This decline resulted, in part, from the revival of local competitor Huawei, but also abnormally high shipments by Apple at the start of 2023 that resulted from earlier production delays.

However, as growth in smartphone markets like China and the U.S. slow, brands that sell premium phones like Apple and Huawei are increasingly looking to emerging markets like Southeast Asia, which are poised for growth.

According to data from Canalys, Southeast Asia’s phone market is forecasted to grow 7% year-over-year in 2024, a much faster rate than that of the rest of the world, which is at 3%. Meanwhile, China is predicted to grow by 1%, and North America’s market is predicted to stay flat.

According to reporting from Bloomberg, Apple’s first retail location in Malaysia is already in the works. Meanwhile, Huawei has been strengthening ties with Southeast Asian partners such as the Indonesian telecommunications company Telkomsel.

In the Canalys report, Indonesia remained the largest Southeast Asian smartphone market, making up 38% of shipments in January. The second largest market, the Philippines, showed the most robust growth with shipments up 77% in January compared to last year.

The next largest markets were Thailand, Vietnam, and Malaysia, in that order. Vietnam was the only country to experience a year-on-year shipment decline, dropping 2%.