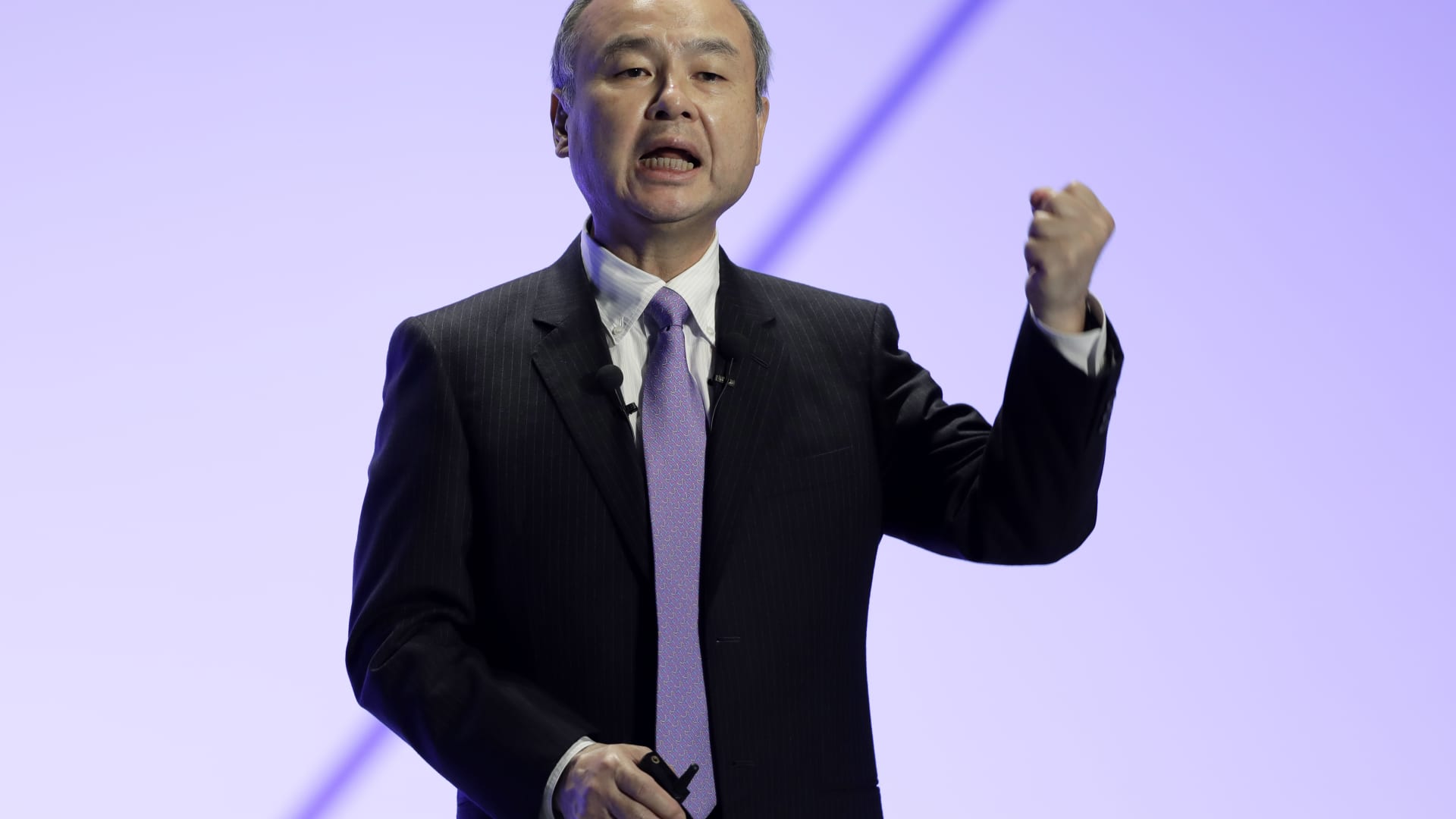

Masayoshi Son, chairman and CEO of SoftBank Group Corp.

Kiyoshi Ota | Bloomberg | Getty Images

Arm shares soared 29% on Monday, extending last week’s rally as investors continue to applaud the chipmaker’s better-than-expected third-quarter earnings and its position in the artificial intelligence boom.

Arm is now up 93% since it reported quarterly financials on Feb. 8, though without any clear catalyst for Monday’s move. The stock has almost tripled since Arm’s initial public offering in September, closing at $148.97, and is now worth almost $153 billion, or a little more than $30 billion below Intel’s market cap.

Last week, Arm said it could charge twice as much for its latest instruction set, which accounts for 15% of the company’s royalties, suggesting it can expand its margin and make more money off new chips. It also said it was breaking into new markets, such as cloud servers and automotive, due to AI demand.

Its royalty strength combined with Arm’s optimistic growth forecast has made the company the latest AI darling among investors, despite a higher earnings multiple than Nvidia or AMD.

However, Arm’s value may become clearer next month when the 180-day post-IPO lockup expires. SoftBank still owns 90% of the outstanding stock, meaning its stake in Arm has increased more than $61 billion since the company’s report last week and is now worth upward of $131 billion.

For the second time in three trading sessions, Arm’s daily volume exceeded 100 million shares, or more than 10 times the average for the stock .

WATCH: Arm have a very clear AI story that will lead to growth

Don’t miss these stories from CNBC PRO: