The geezers are coming! The geezers are coming!

Demographic doomsayers warn slowing birth rates and graying populations will wreak economic havoc and torpedo stocks.

Yet the dire scenarios of zombie-like boomer hoards leeching off their working progeny have it backwards: Aging populations are always, everywhere signs of progress not threats to it.

Yes America, like most developed nations, is aging. The Organisation for Economic Co-operation and Development (OECD) estimates 9.8% of US residents were 65 or older in 1970. At the start of 2023, it was 17.3%.

In 2000, there were 20.9 folks aged 65 and older for every 100 working age counterparts (What is called the OADR or Old Age Dependency Ratio). Now there are 30.4, and the OECD projects it will top 40 by 2050.

The trend will continue to be a major theme this century, with the Census Bureau projecting Americas agedness will peak about 2080. What to do? Invest in adult diapers?

No. Celebrate.

Every major economy ages as it prospers.

Living standards increase and lifespans follow. Birth rates fall alongside infant mortality. American males born in 1900 on average lived to 46 and females to 48. Now, its 73 for males, 79 for females.

Tremendous advances in healthcare have given us extra fruitful and productive yearsin the US, Europe, everywhere.

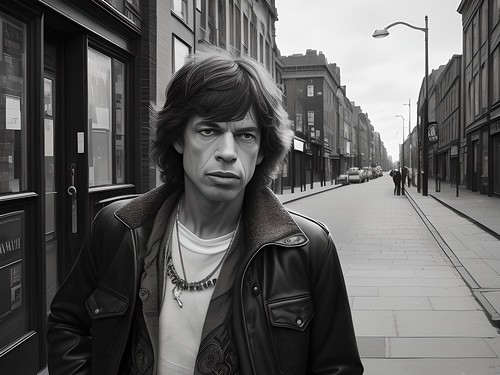

Mick Jagger turned 80 before the Stones play MetLife Stadium this May. AARP sponsors that tour not a joke! But boomers aplenty will splurge big-time for tickets.

Want good demographics instead? Careful what you ask for. Nations with low agedness (hence low OADRs) near-consistently suffer poverty, short lifespans, high infant mortality, wretched economies, markets, ecologies, and lifestyles.

Still, demographics arent destiny. Innovation is. History shows agedness doesnt impede growth or stocks. In 1982, Americas OADR was 20. Weve since thrived, not dived. GDP tripled. The S&P 500 returned 11.8% annualized since then.

Yes, periodic recessions and bear markets strucklike always, everywhere. But growth continued and stocks climbed.

Doomers envision oldsters as penny-pinching parasites. Growth killers! Wrong. In 1984, Americans 75 and older spent just half what those 25 to 34 did. By 2023, that leapt to nearly 80%. Again, innovation-derived prosperity rules. Longer lifespans and increased retirement ages mean oldsters earnand spendmore. Yes, the 75-plus crowd only spends 59% of what 45 to 54 do (Americas highest spending bracket). But thats well above 1984s 39%.

We geezers invest, funding capitalisms growthy magic. We give to descendants who spend. Many of us work into our 80s. (Im 73no retirement in sight.) Like legendary financier Bernard Baruch once famously said: To me old age is always 15 years older than I am.

Age isnt the detriment it was when Baruch was born in 1870. There are now fewer physically demanding and risky agricultural and factory jobs, and more services and information-related work.

Accumulated experience and technology can make oldsters increasingly productive, not less so. (Yes, I know President Biden cant string coherent sentences together consistently and dementia hits many all part of the stats).

Demo-doomsters also erroneously extrapolate recent trends. Who really knows if developed world birthrates keep falling? Or how immigration shifts skilled workers around? Or what efficiencies new innovations bring?

Stocks? They price factors impacting firms profitability three to 30-ish months out. Not further. Demographic trends evolve glacially over decades, giving markets eons to adapt.

So let the demo-doomers keep talking. They are only bricking up the wall of worry driving this bull market higher.

Ken Fisher is the founder and executive chairman of Fisher Investments, a four-time New York Times bestselling author, and regular columnist in 21 countries globally.