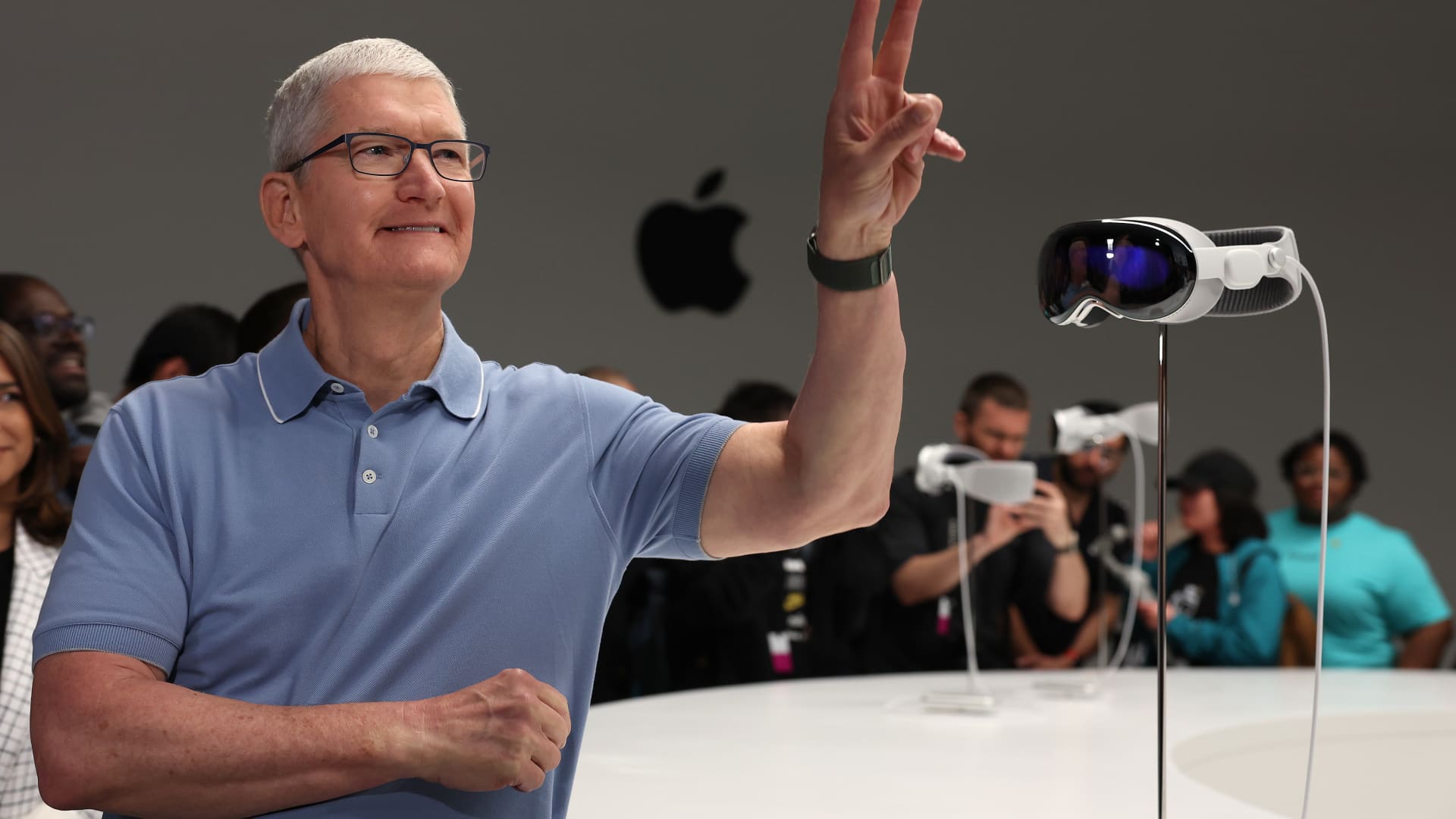

Apple CEO Tim Cook stands next to a new Apple Vision Pro headset displayed during the Apple Worldwide Developers Conference in Cupertino, California, June 5, 2023.

Justin Sullivan | Getty Images

Apple’s stock rallied in 2023, but its performance was outshined by all of its mega-cap tech peers, as the company suffered four straight quarters of declining revenue. It’s the longest such slide for Apple since the dot-com bust of 2001.

Some of Apple’s troubles this year were due to a bad economic environment for phones and computers. Over the summer, total smartphone sales were the slowest in more than a decade.

But Apple also dealt with some company-specific issues. Apple didn’t release new iPad models in 2023, the first time that’s happened in a calendar year since the product was launched in 2010. Without new models, Apple has less to promote, and older versions of the product don’t see official price cuts that boost sales.

Earlier this month, all current model iPads were shipping from Apple’s website in a day, according to Morgan Stanley analysts. That’s a sign of weak demand because with the hottest products, Apple doesn’t have enough supply to ship that quickly.

In fiscal 2023, which ended in September, Apple’s iPad revenue dropped 3.4% to $28.3 billion. On a unit basis, iPad sales were even worse, falling 15%, according to a recent estimate from Bank of America analyst Wamsi Mohan. Apple doesn’t report unit sales.

To make matters worse, new Apple Watch models were removed from Apple stores in the U.S. days before Christmas over an intellectual property dispute. After a late December appeal, the devices have been returned to store shelves, but Morgan Stanley analysts estimate Apple lost about $135 million in sales per day during the brief ban.

Even for Apple’s new products, like Mac computers, consumers showed less interest in opening their wallets for devices with minor upgrades. Sales of Mac PCs and laptops fell nearly 27% to $10.2 billion in fiscal 2023. Unit sales declined 11%, according to Bank of America’s estimate.

Apple shares still managed to jump 49% for the year as of Thursday’s close, topping the Nasdaq’s 44% gain. However, investors were better off betting on any of the other most-valuable tech companies. Nvidia shares more than tripled this year, and Meta climbed almost 200%. Tesla’s stock more than doubled, Amazon rose 83%, Alphabet jumped 59% and Microsoft gained 57%.

In order to return to revenue growth and support its $3 trillion market cap, Apple needs some new products to hit and global demand for smartphones and laptops to recover.

A big test will come early next year, when Apple’s first mixed-reality headset — the $3,499 Vision Pro — hits the market.

“We believe success with the Vision Pro is less about 2024 and more about its longer-term potential,” Morgan Stanley analyst Erik Woodring wrote in a note this month.

Assuming Apple ships 400,000 headsets, Vision Pro revenue could be about $1.4 billion next year, according to an estimate from UBS analyst David Vogt. He called the sum “relatively immaterial.”

Enthusiasm will be the key. The Vision Pro is Apple’s first completely new device since it announced the Apple Watch, and it will be sold through Apple stores. The headset could generate foot traffic and buzz for Apple’s existing products. And there’s a chance that it catches on enough to show that Apple has the lead when it comes to the future of computing.

Some problems are fixable

Looking overseas, Apple would like to see an easing of tensions between the U.S. and China.

In 2023, Apple made significant progress diversifying its centers of production away from mainland China and into countries like Vietnam and India. But its moves to expand its supply chain appear to have awakened an impulse in the Chinese government to classify Apple as a foreign company. The White House called reports that Chinese government agencies told their employees not to bring iPhones to work “retaliation.”

The Chinese government has denied them. Yet analysts are starting to worry that Chinese demand for iPhones, especially in the current quarter, is flagging. The iPhone remains Apple’s most important hardware product, accounting for about half of total company revenue.

“Heading into the holiday season, iPhone unit demand remains the key near-term debate amidst macro woes and concerns around potential share loss in China on the resurgence of Huawei,” Citi analyst Atif Malik wrote in a note this month.

Despite its struggles, Apple remains a juggernaut. The company recorded $383 billion in total revenue in fiscal 2023 and earned nearly $97 billion in net income.

Because the smartphone and PC markets were in retreat, Apple gained market share in some countries, where rivals saw steeper declines. In February, Apple said it had 2 billion devices in use, a closely watched metric that investors see as a predictor of future sales from software and services.

Apple is preparing new iPads for next year, which could boost demand, according to Bloomberg. The company has submitted a software update for its watches to the U.S. government that it hopes will clear up the intellectual property dispute that briefly banned sales. IPhones still have a speed advantage over Huawei’s new devices, partially thanks to import restrictions on chips and chip equipment.

In November, Apple CFO Luca Maestri said the company’s December quarter — its biggest of the year — will be flat compared with last year. He warned that Macs, Wearables and iPads would see a sales drop.

But according to analyst estimates, the total sales declines are in the rearview mirror, with mild growth expected in the first half of the year and acceleration after that.

“Overall, the downturn appears to be over, and we believe it is time to see mild growth,” Bank of America analyst Simon Woo wrote in a report this month.

WATCH: Apple’s Vision Pro is not expected to be mainstream hit