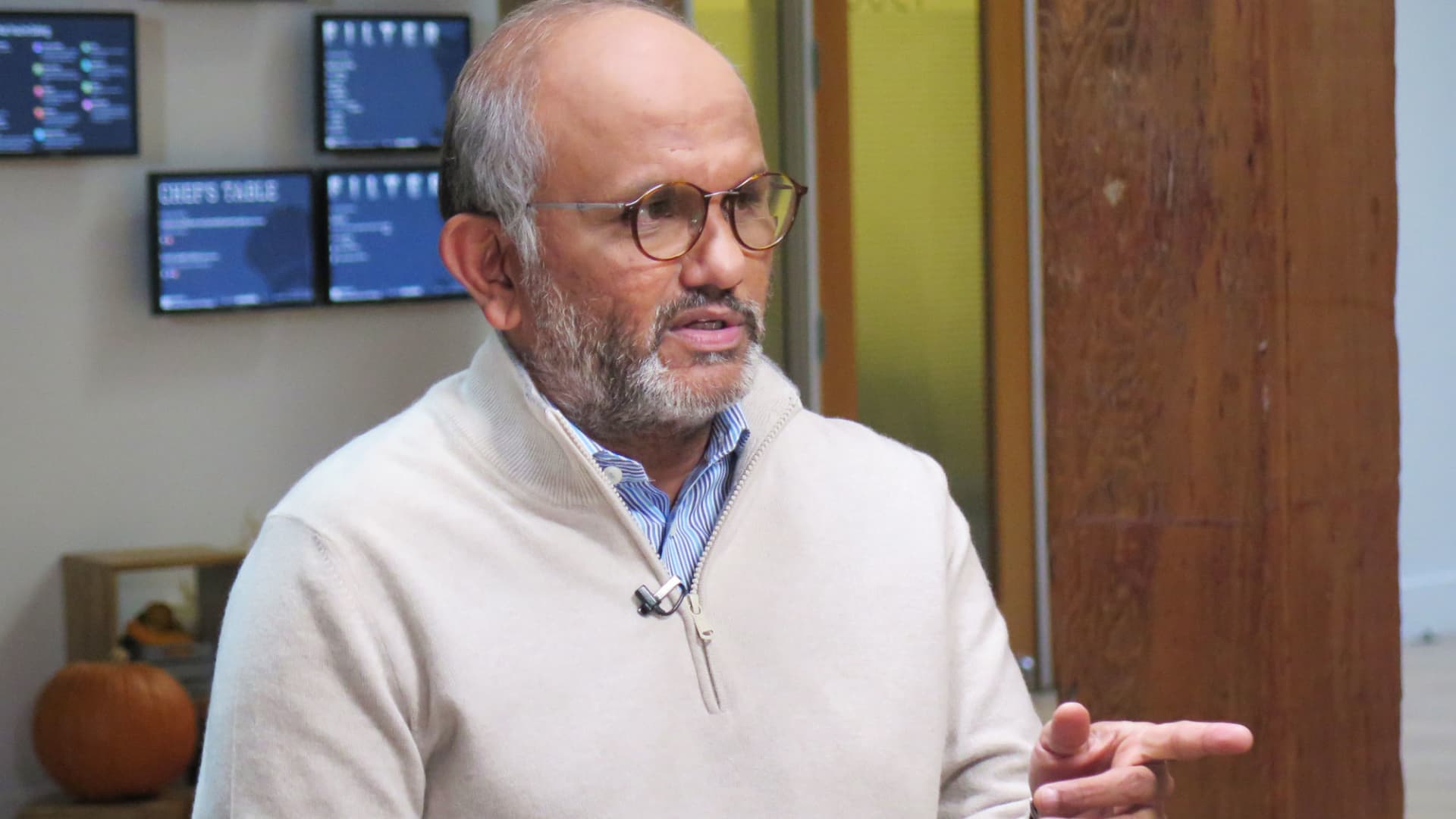

Adobe CEO Shantanu Narayen.

Linda Dimyan | CNBC

Adobe shares dropped more than 6% in extended trading Wednesday after the software maker posted a lighter-than-expected forecast for 2024.

Here’s how the company did, compared to consensus estimates from LSEG, formerly known as Refinitiv:

- Earnings per share: $4.27, adjusted vs. $4.14 expected

- Revenue: $5.05 billion vs. $5.03 billion expected

Revenue grew almost 12% from a year ago in the fiscal fourth quarter, which ended Dec. 1, according to a statement. Net income increased 26% to $1.48 billion, or $3.23 per share, up from $1.18 billion, or $2.53 per share, in the year-ago quarter.

While results for the latest quarters topped estimates, Adobe’s guidance for the new fiscal year disappointed Wall Street.

Adobe called for fiscal 2024 earnings per share of $17.60 to $18 on $ $21.3 billion to $21.5 billion in revenue. Analysts polled by LSEG had expected $18 in adjusted earnings per share and $21.73 billion in revenue.

Executives continue to look carefully at spending, Anil Chakravarthy, president of Adobe’s experience business that includes marketing software, said on a conference call with analysts.

Adobe’s CEO, Shantanu Narayen, acknowledged questions about forward-looking recurring revenue the company could derive from subscriptions to the Creative Cloud software bundle. During the quarter Adobe increased the costs of some subscriptions.

‘We’re extremely confident about how that continues to be a growth business, and perhaps the pricing impact was overestimated,” Narayen said.

Also in the quarter, Adobe’s Firefly generative artificial intelligence features became available in the Photoshop and Illustrator programs for Creative Cloud subscribers. An enterprise version of the Firefly web app that can create images based on a few words of human input also became available.

Adobe remains focused on closing the $20 billion Figma acquisition it announced in September 2022. The company said it disagrees with findings from regulators in the European Commission and the U.K. and that it’s responding to regulators. The U.S. Department of Justice has also been looking into the planned deal.

“While the DOJ does not have a formal timeline to decide whether to bring a complaint, we expect a decision soon,” Narayen said.

The guidance does not factor in impact from Figma.

Adobe said in a separate regulatory filing that it has been working with the U.S. Federal Trade Commission on an inquiry over cancellation and subscription practices in connection with the Restore Online Shoppers’ Confidence Act. The FTC told the company in November that it had the authority to enter into consent negotiations to see if a settlement could be reached, according to the filing. Adobe sees its past behavior as lawful and said the matter might have a material effect on financial performance.

Prior to the after-hours move, Adobe shares were up almost 86% this year, outperforming the S&P 500 stock index, which has gained about 23%.

Don’t miss these stories from CNBC PRO: