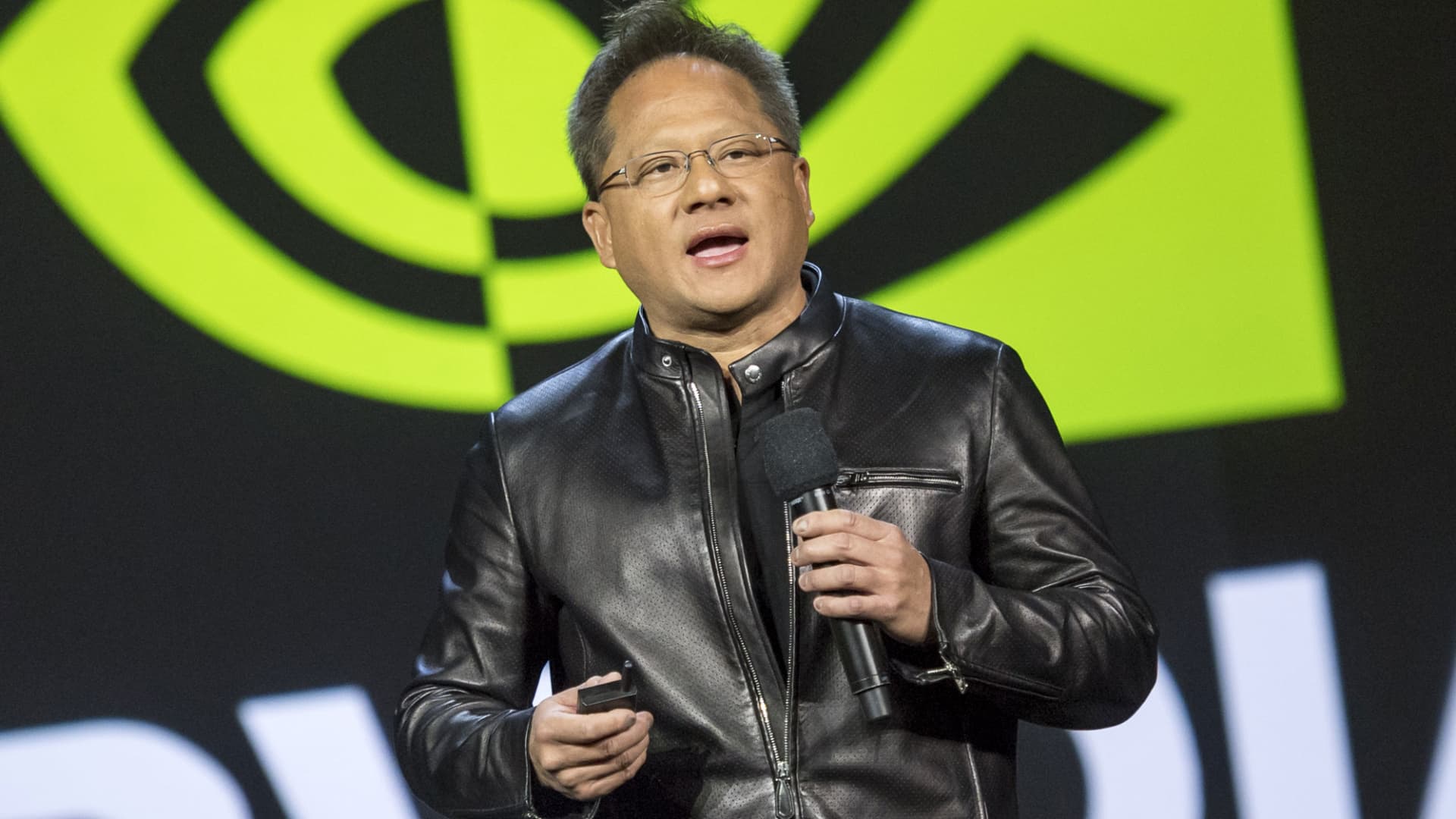

Jen-Hsun Huang, CEO, Nvidia

David Paul Morris | Bloomberg | Getty Images

As long as companies are interested in generative artificial intelligence, Nvidia stands to benefit.

Nvidia shares closed up more than 7% on Monday, underscoring how investors believe the company’s graphics processing units, or GPUs, will continue to be the most popular computer chips used to power massive large language models that can generate compelling text.

Morgan Stanley released an analyst note Monday reiterating that Nvidia continues to be a “Top Pick” coming off the company’s most recent earnings report, in which it offered a better-than-expected forecast.

“We think the recent selloff is a good entry point, as despite supply constraints, we still expect a meaningful beat and raise quarter — and, more importantly, strong visibility over the next 3-4 quarters,” the Morgan Stanley analysts wrote. “Nvidia remains our Top Pick, with a backdrop of the massive shift in spending towards AI, and a fairly exceptional supply demand imbalance that should persist for the next several quarters.”

Nvidia, now valued at over $1 trillion, bested all other companies during this year’s tech rebound following a market slump in 2022, with the chip giant’s shares up nearly 200% so far in 2023.

Although Nvidia shares dropped a little more than 10% this month, partly attributed to supply constraints and ongoing concerns over the broader economy and whether it will experience a significant rebound, the Morgan Stanley analysts predict that Nvidia will benefit in the long run.

“The bottom line is that this is a very positive situation, October numbers are entirely gated by supply, and the upper end of the buy side consensus has been reined in,” the analysts wrote. “We see numbers are going up at least enough that this stock will trade at P/Es more similar to the upper end of semis, with material upside still ahead.”

Nvidia’s stock has tripled this year. The company will announce second-quarter results Aug. 23.