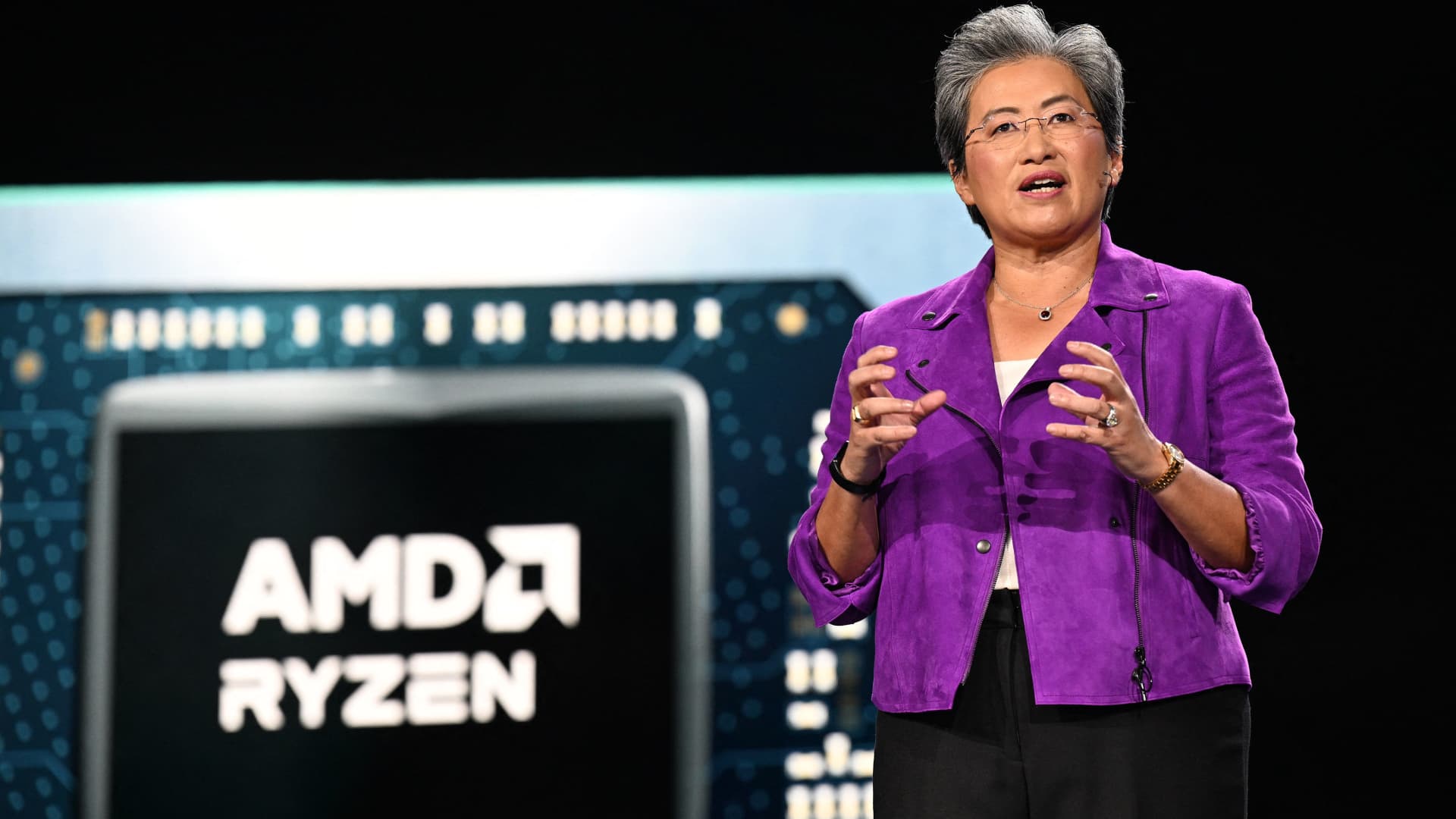

AMD Chair and CEO Lisa Su speaks at the AMD Keynote address during the Consumer Electronics Show (CES) on January 4, 2023 in Las Vegas, Nevada.

Robyn Beck | Afp | Getty Images

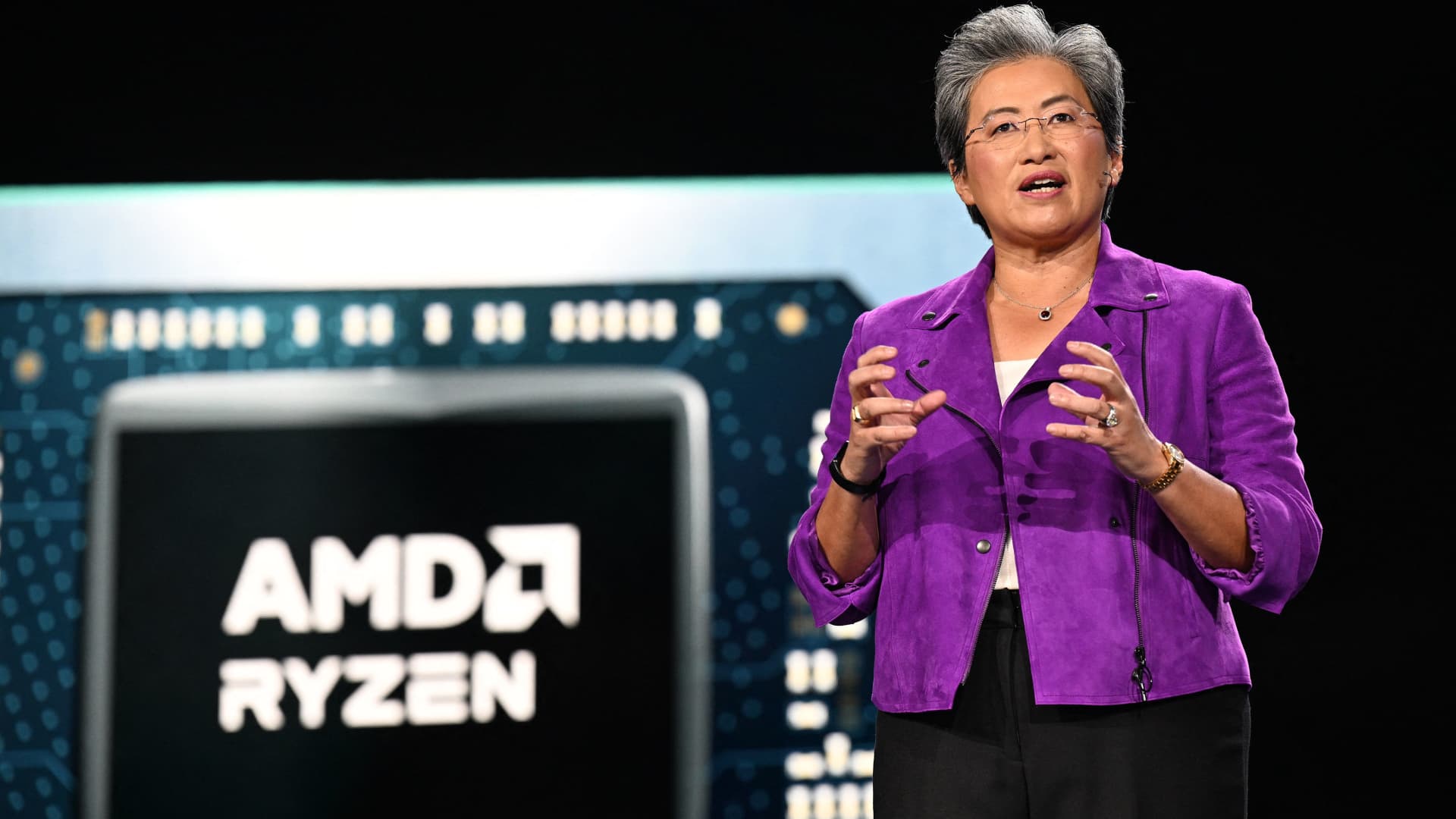

AMD Chair and CEO Lisa Su speaks at the AMD Keynote address during the Consumer Electronics Show (CES) on January 4, 2023 in Las Vegas, Nevada.

Robyn Beck | Afp | Getty Images

“As we think about certainly the accelerator market, our plan is to of course be fully compliant with U.S. export controls but we do believe there’s an opportunity to develop products for our customer set in China that is looking for AI solutions and we’ll continue to work in that direction,” Su said.

Accelerator chips are the kind of semiconductors required to train huge amounts of data for artificial intelligence applications.

AMD is gearing up to increase production of its MI300 chip which it is positioning as a rival to Nvidia’s graphics processing units used for AI training. Nvidia dominates the market but AMD is hoping to challenge it with its latest chip.

Earlier this year, the U.S. government restricted Nvidia from selling its A100 and H100 chips to China. The H100 is one of Nvidia’s key AI chips. Nvidia decided to create a chip with tweaks to the H100’s specifications that complied with the export curbs.

Intel also made a modified version of its its Gaudi 2 AI chips for the Chinese market.

China remains a lucrative market for U.S. chipmakers, particular in AI where there are few homegrown alternatives to the likes of Nvidia.

For AMD, a lot is riding on its MI300 AI chip as it looks to take on Nvidia. The company is expecting the chip to help it rapidly grow its data center business for the rest of the year.

Su said AMD is looking at around 50% growth in the second half of the year versus the first half in its data center business, in part thanks to the new AI chip.